Many small business owners, freelancers, and first-time entrepreneurs begin their journey by using a single bank account for everything. Business receipts are credited to the same account where household expenses are paid, and personal savings are often used to meet business needs. Initially, this feels convenient and harmless, especially when the business is small.

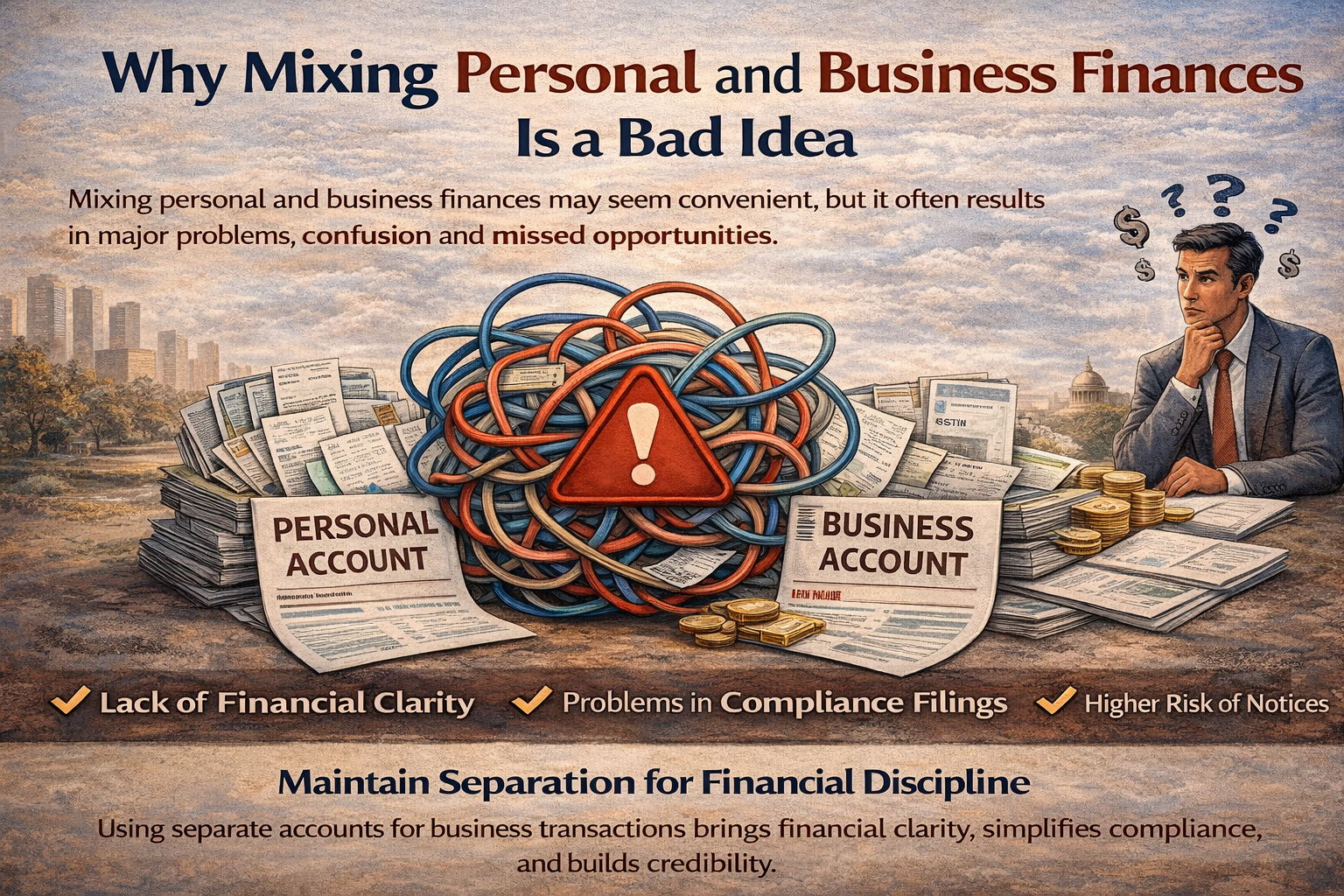

However, mixing personal and business finances is one of the most common and costly mistakes made by small businesses. While it may not cause immediate trouble, it almost always leads to financial confusion, compliance issues, and unnecessary stress in the long run.

Lack of Financial Clarity Creates Confusion

When personal and business transactions are routed through the same account, it becomes difficult to understand the true financial position of the business. Business income gets mixed with personal transfers, savings, and household expenses, making it hard to identify actual turnover, real expenses, and genuine profits or losses.

As a result, many business owners are unable to answer basic questions such as how much the business earned, how much was spent for business purposes, or whether the business is genuinely profitable. This lack of clarity affects decision-making and often leads to poor financial planning.

Problems During Compliance and Filings

Mixing finances becomes especially problematic during statutory filings and compliance work. Whether it is income reporting, GST reconciliation, or responding to notices, authorities expect business transactions to be identifiable and explainable.

When personal expenses appear in business records or business receipts are treated as personal funds, it becomes difficult to justify figures. Even genuine transactions may appear suspicious due to poor segregation, leading to unnecessary explanations, reconciliations, and scrutiny.

Higher Risk of Notices and Queries

Government systems increasingly rely on transaction data reported by banks and third parties. When a single account shows large deposits and withdrawals without a clear business pattern, it raises questions.

While the issue may not be wrongdoing, the inability to clearly distinguish personal funds from business receipts often results in queries and notices. Responding to such notices becomes stressful when records are not clean and organised.

Difficulty in Claiming Genuine Business Expenses

One of the biggest disadvantages of mixed finances is the inability to confidently claim business expenses. When personal and business spending happens from the same account, identifying which expense was incurred for business purposes becomes challenging.

In the absence of clarity, business owners either under-claim expenses due to fear or over-claim without proper backing, both of which can create problems later. Proper expense identification is possible only when business finances are maintained separately.

Issues While Seeking Loans or Investment

Banks, financial institutions, and potential investors look for clear financial statements before extending credit or funding. When accounts are mixed, financial statements lose credibility and transparency.

Even a profitable business may struggle to obtain loans simply because its financial records do not reflect a clear separation between business and personal funds. Clean books often matter more than high turnover when it comes to financial credibility.

Legal and Liability Concerns

For structured entities such as partnerships, LLPs, and companies, mixing finances can create legal complications. Business funds are expected to be used strictly for business purposes. Using them for personal needs without proper documentation may lead to disputes among partners or compliance issues.

In extreme cases, poor financial discipline can weaken the legal distinction between the business and the individual, increasing personal exposure to business risks.

Stress During Audits and Reviews

Audits, internal reviews, or professional checks become time-consuming and stressful when transactions are mixed. Professionals have to spend extra time segregating entries, seeking explanations, and reconstructing records.

This not only increases compliance costs but also delays important work and creates avoidable pressure for the business owner.

A Simple Habit That Prevents Bigger Problems

Maintaining a separate bank account for business transactions is a simple step that brings discipline, clarity, and peace of mind. It helps track performance accurately, simplifies compliance, and builds financial credibility.

Even for small businesses and freelancers, separation of finances is not about size—it is about good governance and long-term sustainability.

Conclusion

Mixing personal and business finances may seem convenient in the early stages, but it often becomes a silent source of financial and compliance problems. What starts as a small shortcut can later result in confusion, notices, disputes, and missed opportunities.

Keeping finances separate is not just a best practice—it is a foundational habit that supports growth, compliance, and financial confidence.