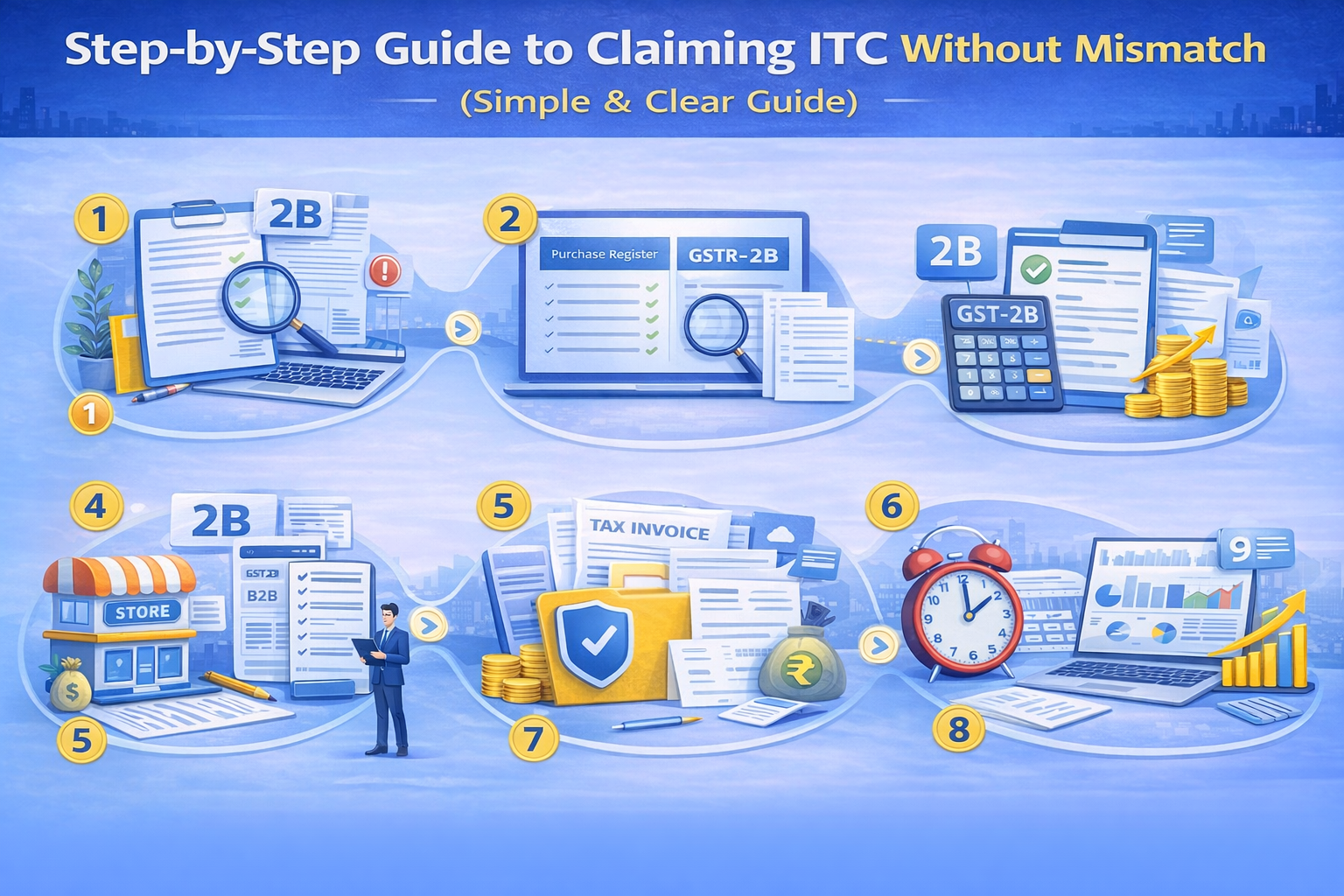

Step-by-Step Guide to Claiming ITC Without Mismatch (Simple & Clear Guide)

Input Tax Credit (ITC) is one of the biggest benefits under GST, but thousands of taxpayers face notices every year due to mismatches between their purchase records and the supplier’s GSTR-1. To avoid penalties, interest, and compliance issues, it’s important to claim ITC correctly and ensure there is no mismatch.

In this blog, we explain a simple, step-by-step process to help you claim ITC smoothly and stay fully compliant.

1. Check Your GSTR-2B Every Month

GSTR-2B is an auto-generated statement that shows all invoices uploaded by your suppliers.

Before claiming ITC, always check:

- Whether the invoice appears in 2B

- Whether the supplier has filed GSTR-1

- Whether the invoice details match your purchase book

Only claim ITC that is visible in GSTR-2B.

2. Reconcile Your Purchase Register With GSTR-2B

Download your GSTR-2B and compare it with your purchase register.

Look for:

- Missing invoices

- Duplicate invoices

- Incorrect GSTIN

- Wrong invoice numbers or dates

- Rate or taxable value mismatch

Fix these issues before claiming ITC.

3. Follow Up With Vendors For Missing Uploads

If an invoice is not appearing in GSTR-2B:

- Ask your vendor to upload it in their GSTR-1

- Ensure they have not wrongly filed under B2C

- Confirm they pay the tax to the government

You should deal only with compliant vendors to avoid ITC blockage.

4. Claim ITC Only Up to the Amount Showing in GSTR-2B

You cannot claim excess ITC beyond what appears in GSTR-2B.

If your books show more ITC than 2B:

- Keep the difference as “ITC to be claimed later”

- Claim it only when it appears in a future GSTR-2B

This avoids notices under Section 16 and mismatch queries.

5. Maintain Complete Documentation

Keep the following documents safely:

- Tax invoice

- Debit notes

- Bill of supply

- Delivery challan (if required)

- E-way bill

- Payment proof to supplier

Documents must be kept for 6 years as per GST rules.

6. Ensure Payment to Supplier Within 180 Days

If payment is not made to the supplier within 180 days:

- You must reverse the ITC

- Pay interest

- Re-claim it again once payment is made

This avoids unnecessary disputes.

7. Avoid ITC on Ineligible Items

Do not claim ITC on:

- Personal expenses

- Motor vehicles (unless allowed)

- Food & beverages

- Insurance

- Gifts

- Works contract (except permitted cases)

Claiming ineligible ITC can lead to penalties.

8. Reconcile Annually Before Filing GSTR-9

Do a yearly reconciliation of:

- GSTR-2B vs Purchase Register

- GSTR-3B ITC vs Books ITC

This ensures your annual return is correct and avoids future scrutiny.

Conclusion

Claiming ITC without mismatch is easy if you follow the correct steps. Regular reconciliation, vendor follow-ups, and strict documentation can save you from notices, penalties, and financial loss.