TDS in a Deceased Person’s PAN After Years: How Legal Heirs Can Claim the Credit

Tax obligations don’t always end with the passing of an individual. In many cases, income such as interest on fixed deposits, dividends, rental income, or returns from other investments continues to accrue even after death. This often creates confusion for legal heirs—especially when Tax Deducted at Source (TDS) continues to be deducted using the PAN of the deceased.

When this happens, heirs frequently find that the TDS credit does not appear in their own tax records, leading to anxiety and, in some cases, denial of legitimate tax benefits.

The good news is that Indian income-tax law clearly protects the rights of legal heirs. Even if TDS is deducted under the deceased person’s PAN, heirs can still lawfully claim the credit—provided the income is taxable in their hands.

This article explains the legal position, the governing rules, and the practical steps heirs should follow to claim TDS credit smoothly.

Understanding the Legal Position: Income After Death

Under Section 159 of the Income-tax Act, 1961, a deceased person’s tax liability is limited strictly to the income earned up to the date of death. Any income that accrues after the date of death does not belong to the deceased—it belongs to:

The legal heir(s), or The estate of the deceased

Accordingly:

Income earned before death → Taxable in the deceased’s PAN

Income earned after death → Taxable in the hands of the legal heir or estate

However, problems arise when banks or financial institutions are not informed of the death in time. As a result, TDS continues to be deducted using the deceased’s PAN, and the TDS credit reflects in the deceased’s Form 26AS or AIS instead of the heir’s records.

Key Principle: TDS Follows Income, Not PAN

The resolution to this issue lies in Rule 37BA(2) of the Income-tax Rules, 1962.

This rule states that TDS credit must be given to the person who is legally liable to pay tax on the income, even if the tax was deducted using another person’s PAN.

In simple terms:

TDS follows income—not the PAN under which it was deducted.

Courts and tax tribunals have repeatedly upheld this principle, holding that the Income Tax Department cannot deny TDS credit merely due to a procedural lapse by the deductor (such as using the wrong PAN).

Once the rightful taxpayer (the legal heir) offers the income to tax and proves that TDS has already been deducted, the corresponding credit must be allowed.

How Legal Heirs Can Claim TDS Credit

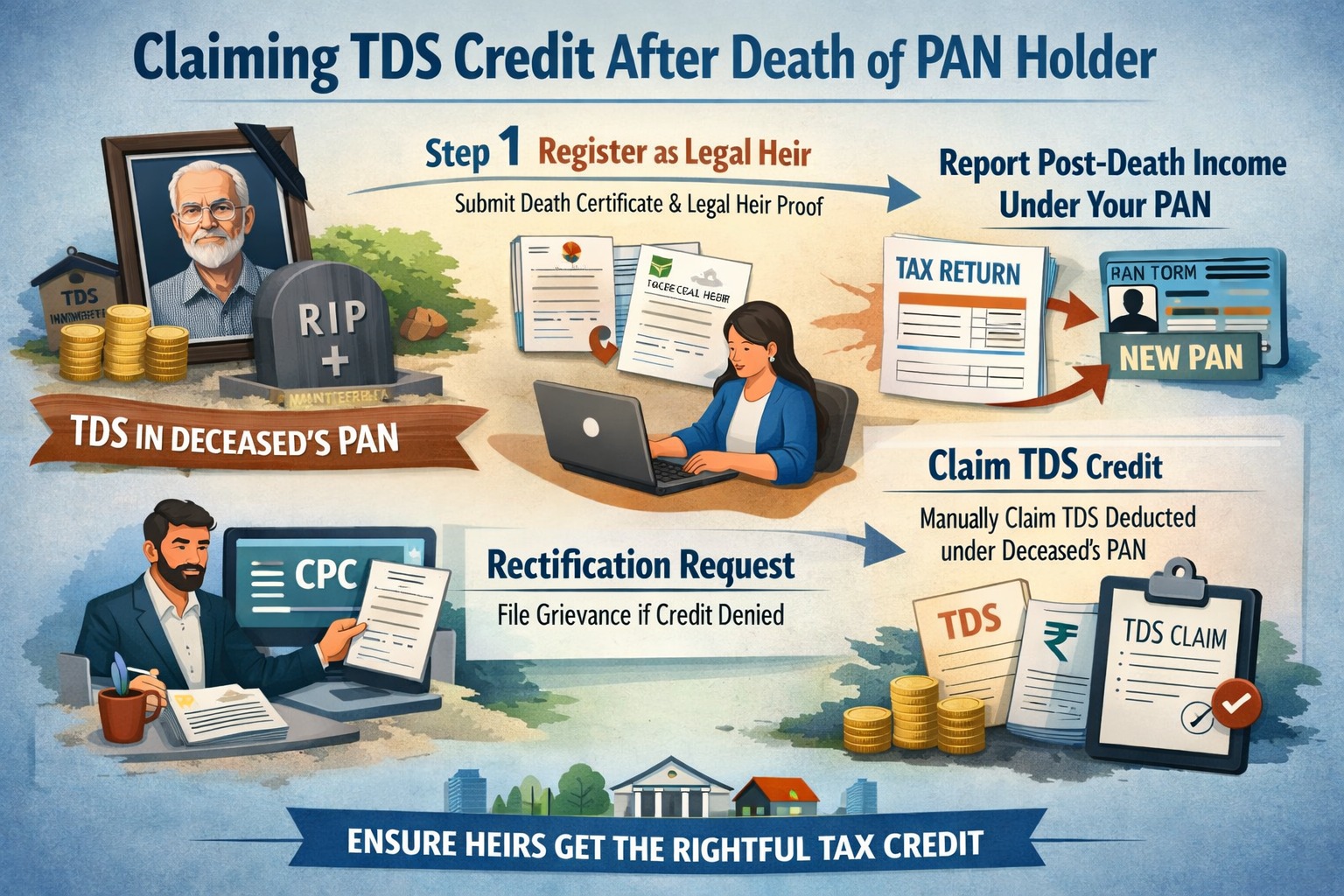

1. Register as a Legal Heir on the Income Tax Portal

The first and most important step is legal heir registration on the income-tax e-filing portal. This requires uploading:

Death certificate of the deceased

PAN of the deceased

PAN of the legal heir

Proof of legal heirship, such as:

Legal heir certificate

Succession certificate

Registered will

Once approved, the legal heir gains authority to handle tax matters related to the deceased.

2. Identify the Correct Nature of Income

It is crucial to correctly bifurcate income:

Income earned up to the date of death

→ To be reported in the deceased’s return

Income earned after the date of death

→ To be reported in the legal heir’s return or the estate’s return

This distinction is essential to avoid scrutiny, reassessment notices, or future disputes.

3. Report Post-Death Income Under Your PAN

All income accruing after death must be declared under:

The PAN of the legal heir, or

A separate PAN obtained for the estate of the deceased

Such income should not be reported under the deceased’s PAN.

4. Claim the TDS Credit Manually

Since the TDS was deducted under the deceased’s PAN, it will not auto-populate in the legal heir’s Form 26AS. Therefore, the credit must be claimed manually while filing the return by providing:

Name and TAN of the deductor

Amount of income

Amount of TDS deducted

Relevant assessment year

Supporting documents such as Form 16A, interest certificates, or bank statements should be preserved to substantiate the claim.

5. File a Rectification or Grievance if Credit Is Denied

If the Centralised Processing Centre (CPC) disallows the TDS credit:

* File a rectification request under Section 154, or

* Submit an online grievance through the e-filing portal

Attach an explanation along with supporting documents. Once verified, CPC usually allows the TDS credit as per Rule 37BA.

Tips to Avoid Future TDS Issues

To prevent recurring problems, legal heirs should take proactive steps:

✔ Update Financial Records Promptly

Inform banks, companies, and other deductors immediately about the death and submit the legal heir’s PAN to stop incorrect TDS deductions.

✔ Obtain a Separate PAN for the Estate

Where multiple heirs are involved, a separate PAN for the estate of the deceased helps streamline income reporting and tax compliance.

✔ Revise TDS Returns (If Possible)

Although not mandatory, requesting the deductor to revise their TDS return and update the legal heir’s PAN can simplify future claims.

Conclusion

Indian tax law is clear and equitable: legitimate tax credits do not lapse merely because of death or technical errors. If income earned after death is rightly taxed in the hands of the legal heir, the corresponding TDS credit must also be granted—even if it was deducted under the deceased’s PAN.

By registering as a legal heir, reporting income correctly, and claiming TDS manually where necessary, heirs can secure their rightful tax credits without undue hardship. In case of denial, remedies through rectification and grievance mechanisms are readily available.

With proper documentation and awareness of the law, claiming TDS credit in such cases is not only possible—it is fully supported by statute and judicial precedent.