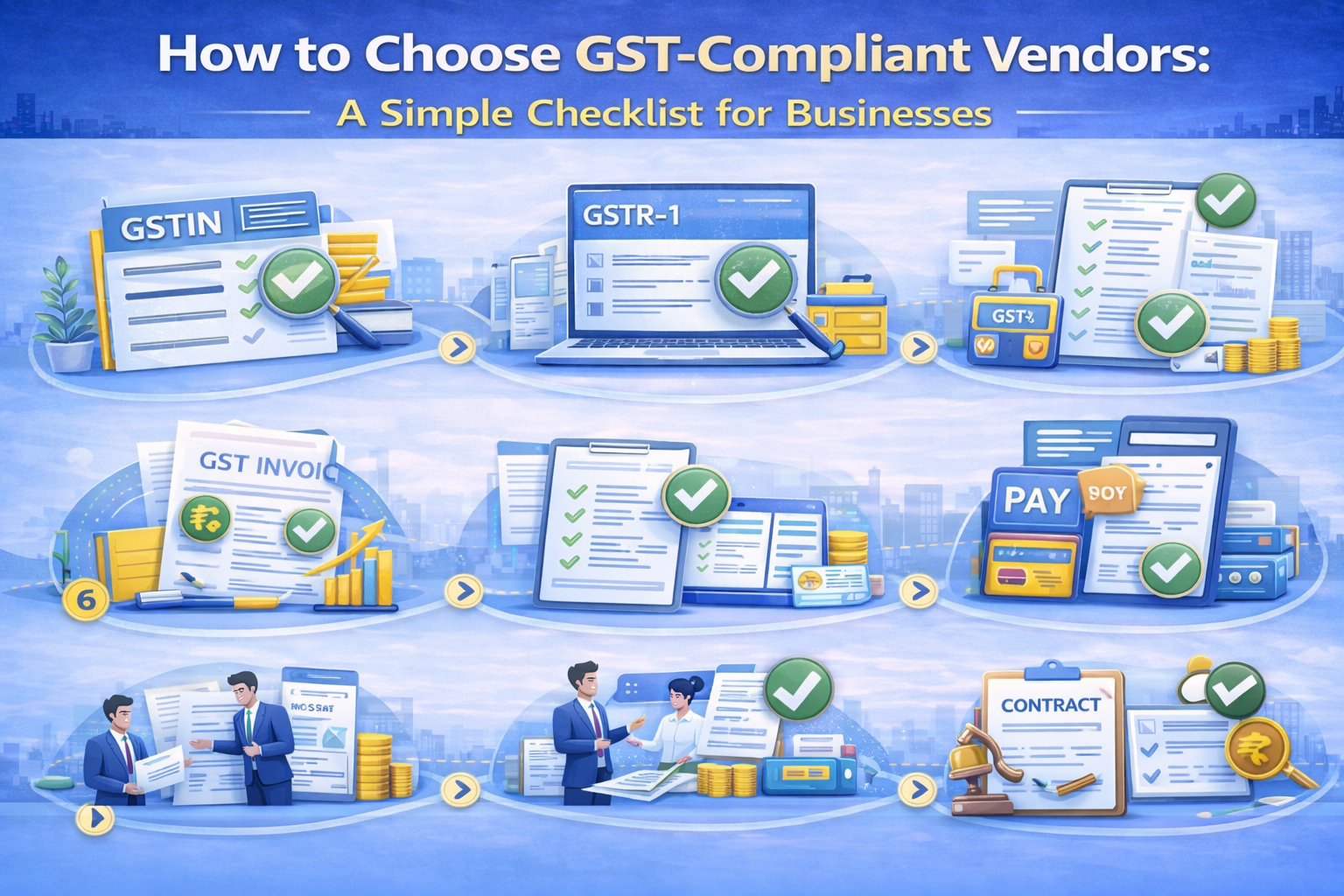

How to Choose GST-Compliant Vendors: A Simple Checklist for Businesses

Choosing the right vendors is one of the most important decisions for any business—not just for operations but also for GST compliance. A non-compliant vendor can cause ITC mismatch, tax liability, penalties, and even GST notices. To avoid these issues, businesses must select vendors who follow GST rules properly.

Here is a simple, practical checklist to help you choose GST-compliant vendors.

1. Check if the Vendor Has a Valid GSTIN

The first step is to verify the vendor’s GST registration.

How to check:

- Visit the GST Portal

- Enter the GSTIN

- Confirm the legal name, status, and type of registration

Avoid dealing with unregistered suppliers for B2B transactions.

2. Ensure the Vendor Files GSTR-1 on Time

If a vendor does not file GSTR-1 regularly, your ITC will not appear in GSTR-2B.

Before onboarding a vendor:

- Ask for their filing status

- Check whether they file monthly or quarterly

- Prefer regular and compliant vendors

A vendor who delays filing can block your ITC.

3. Review the Vendor’s Past Compliance Track Record

A vendor’s history can tell you a lot about their reliability.

You should check:

- Late filing history

- Past mismatches

- Consistency in invoice reporting

Vendors with poor compliance create risk for your business.

4. Ask for Proper GST-Compliant Invoices

A GST invoice must contain:

- Vendor name

- GSTIN

- Invoice number and date

- HSN/SAC code

- Taxable value

- CGST/SGST/IGST details

- Place of supply

Incorrect invoices lead to ITC mismatch.

5. Ensure the Vendor Charges Correct GST Rates

Incorrect GST rates can lead to notices and reversal of ITC.

How to verify:

- Check HSN/SAC codes

- Confirm applicable GST rate

- Match with government notifications

A small rate error can cause big compliance problems.

6. Confirm That the Vendor Accepts Digital Payments

Payments made through banking channels help:

- Track transactions

- Prove payment within 180 days

- Support ITC claims

Avoid vendors who follow cash-only practices.

7. Ask if They Reconcile Monthly With Their Clients

A compliant vendor usually:

- Reconciles GSTR-1 with 2A/2B

- Shares reconciliation reports

- Corrects mistakes in future returns

This reduces the chances of mismatch.

8. Choose Vendors Who Are Transparent in Communication

Good vendors:

- Respond quickly

- Correct wrong invoices

- Upload missing invoices

- Share return filing proofs

Poor communication is a red flag for compliance risk.

9. Include GST Compliance Clauses in the Vendor Agreement

Always include clauses such as:

- Vendor must file GSTR-1 on time

- Vendor must upload correct invoices

- You can hold payment if they fail compliance

- Penalty for mismatch caused by their negligence

A written agreement protects your business.

Conclusion

Selecting GST-compliant vendors is essential to avoid ITC blockage, GST notices, and unnecessary tax burdens. By using this simple checklist—valid GSTIN, on-time filing, clean invoices, correct GST rates, and transparent communication—you can ensure smooth GST compliance for your business.